Gold EA for MT5 – Transparent Rules, Real Stats, and Safe Risk Controls

Looking for a best Gold EA style system that avoids martingale, avoids grid, and uses a fixed stop loss and take profit on every trade? You are in the right place. This proprietary Gold trade EA focuses on disciplined entries and strict risk, which makes it a practical choice for prop firms and personal accounts.

Bottom Line Up Front

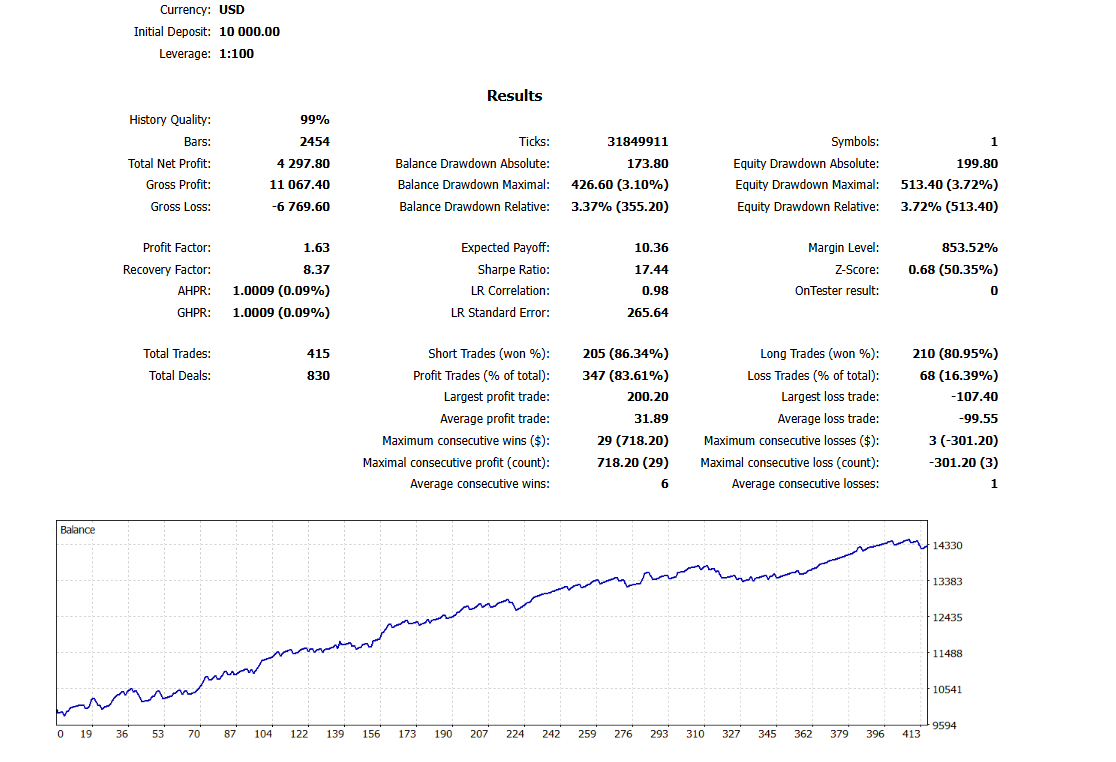

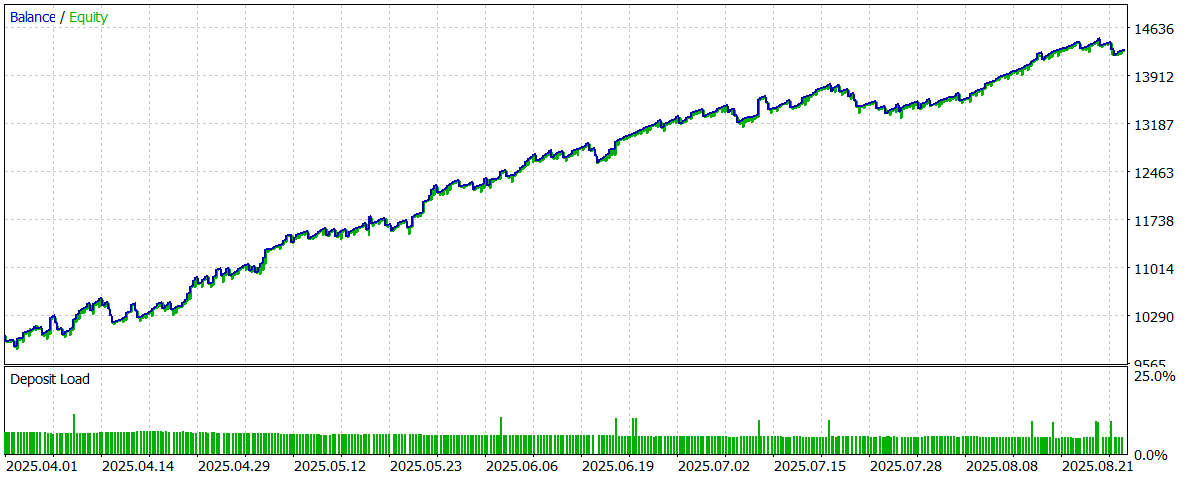

Five months of backtesting at 1% risk per trade grew a 10,000 USD test account by $4,297.80 which is about +42.98%. Reported profit factor 1.63, history quality 99%, and recovery factor 8.37. Every position uses a defined stop loss and take profit. No martingale. No grid. That philosophy is what makes it prop firm friendly.

Data source: MT5 Strategy Tester. Leverage 1:100. Initial deposit 10,000 USD. Period: ~5 months. See full report and video below.

How This Gold EA Works

The EA trades XAUUSD on MT5 with a rule based approach. It looks for clean momentum from key session structure and places pending orders with defined stops and targets. There is no averaging down and no order multiplier. You get one clear position at a time with risk capped from entry.

Core Entry Logic

- Session breakouts and structure to catch controlled momentum in gold.

- Price discipline that cancels stale orders and prevents overlaps.

- One trade idea at a time per logic set to keep exposure simple.

What It Does Not Do

- No martingale

- No grid

- No hedging pyramids

Settings and Risk Controls

Use these defaults as a starting point and adjust to your broker conditions. The EA was designed to keep risk visible and simple.

| Setting | Recommended | Notes |

|---|---|---|

| Risk per trade | 1% | Used in the five month test window. |

| Stop loss | Fixed in pips | Always set at entry. No exceptions. |

| Take profit | Fixed in pips | Always set at entry for clean R multiples. |

| Trade filter | Session structure | Avoids thin liquidity windows. |

| Max concurrent positions | 1 per logic set | Helps keep margin stable. |

| Platform | MT5 | Use a low latency VPS for best fills. |

Tip: If you trade a prop firm, align lot sizing with their daily drawdown rules. See our guide on MT5 risk controls for FTMO US.

Why Gold and When to Trade

Gold offers high liquidity during London and New York sessions. That is when spreads are tight and momentum is cleaner. The EA focuses on those windows and ignores noise. You get fewer but better quality signals that respect a risk first plan.

- Pairs well with disciplined accounts that want consistency over thrill.

- Clear stops allow precise risk budgeting per day and per week.

- Fits traders who prefer a simple rule set that is easy to audit.

If you are comparing platforms, read our breakdown of MT4 vs MT5 vs cTrader vs DXtrade for gold.

Backtests and Evidence

This section shows the exact images and the full video from the five month MT5 Strategy Tester run at 1% risk per trade and 1:100 leverage.

Headline Results

- Net Profit: $4,297.80 (~+42.98%)

- Profit Factor: 1.63

- Max Equity Drawdown: 3.72% ($513.40)

- Total Trades: 415

- Profit Trades: 83.61%

- Short Wins: 86.34% · Long Wins: 80.95%

- Max Consecutive Wins: 29

- History Quality: 99%

What This Means

The profit factor and drawdown profile show a system that grows steadily while keeping risk contained. Because stops are fixed, equity dips are small and short lived. That combination is attractive for evaluations that penalize large daily drawdowns.

Past performance in a tester cannot guarantee future results. Use forward tests on a demo or small live account before scaling.

Prop Firm Suitability

This EA was designed with evaluation rules in mind. It keeps risk per trade small and avoids tactics that most firms prohibit.

- Compliance by design: no martingale, no grid, no hedging pyramids.

- Hard stop on every trade: risk is known before entry.

- Daily control: you can cap daily loss by limiting the number of trades and setting a daily cut time.

For a deeper checklist, see How to pass the FTMO US Challenge.

Important: Each firm has its own rules. Always confirm news filters, symbol restrictions, and max exposure guidelines with your provider.

Detailed Metrics

| Metric | Value | Comment |

|---|---|---|

| Initial Deposit | $10,000 | MT5 Strategy Tester |

| Net Profit | $4,297.80 | ~+42.98% on capital |

| Gross Profit | $11,067.40 | Before losses |

| Gross Loss | -$6,769.60 | Sum of losing trades |

| Profit Factor | 1.63 | Gross profit / Gross loss |

| Expected Payoff | $10.36 | Average per trade |

| Max Equity DD | 3.72% ($513.40) | Contained dips |

| Total Trades | 415 | 830 deals |

| Win Rate | 83.61% | Profit trades |

| Largest Win | $200.20 | Single trade |

| Largest Loss | -$107.40 | Single trade |

| Avg Win | $31.89 | Per profit trade |

| Avg Loss | -$99.55 | Per loss trade |

| Max Consecutive Wins | 29 ($718.20) | Streak stability |

| Max Consecutive Losses | 3 (-$301.20) | Streak control |

| Sharpe Ratio | 17.44 | Per tester report |

All numbers taken from the report image above.

Transparency and Operating Principles

- Results first: you can review screenshots and the full video on this page.

- Risk comes first: the EA never removes the stop loss. There is always a defined exit.

- No high risk tricks: no martingale, no grid. The system does not chase or stack orders.

Want the full details or a guided setup?

Reach out and I will share setup notes, risk templates, and a short checklist you can follow on any broker.

I have personally used this EA to pass an evaluation. Results vary by broker conditions, spreads, and discipline. Trade at your own risk.

Gold EA FAQs

Does this EA use martingale or grid?

No. The EA uses a single position per logic set with a fixed stop loss and fixed take profit. There is no order multiplier and no grid layer.

Is there a stop loss and take profit on every trade?

Yes. Both are placed at order entry. This keeps risk visible and helps with prop firm rules.

Can I use this to pass prop firm challenges?

The strategy is built to respect common rules and small daily drawdowns. Many traders use disciplined systems for evaluations. There is never a guarantee of a pass. Test on demo first and size conservatively.

Which platform and symbol should I use?

MT5 on the XAUUSD symbol. Use a low latency VPS and a broker with tight spreads during London and New York hours.

What account size works best?

Any size you can risk responsibly. Keep risk per trade small. The five month test used 1% risk per trade on a 10,000 USD balance.

How often does it trade?

It is selective. Expect activity when sessions overlap and structure aligns. Quality is preferred over frequency.

Helpful Guides

Disclaimer: Trading involves risk. The information on this page is educational and does not constitute financial advice.